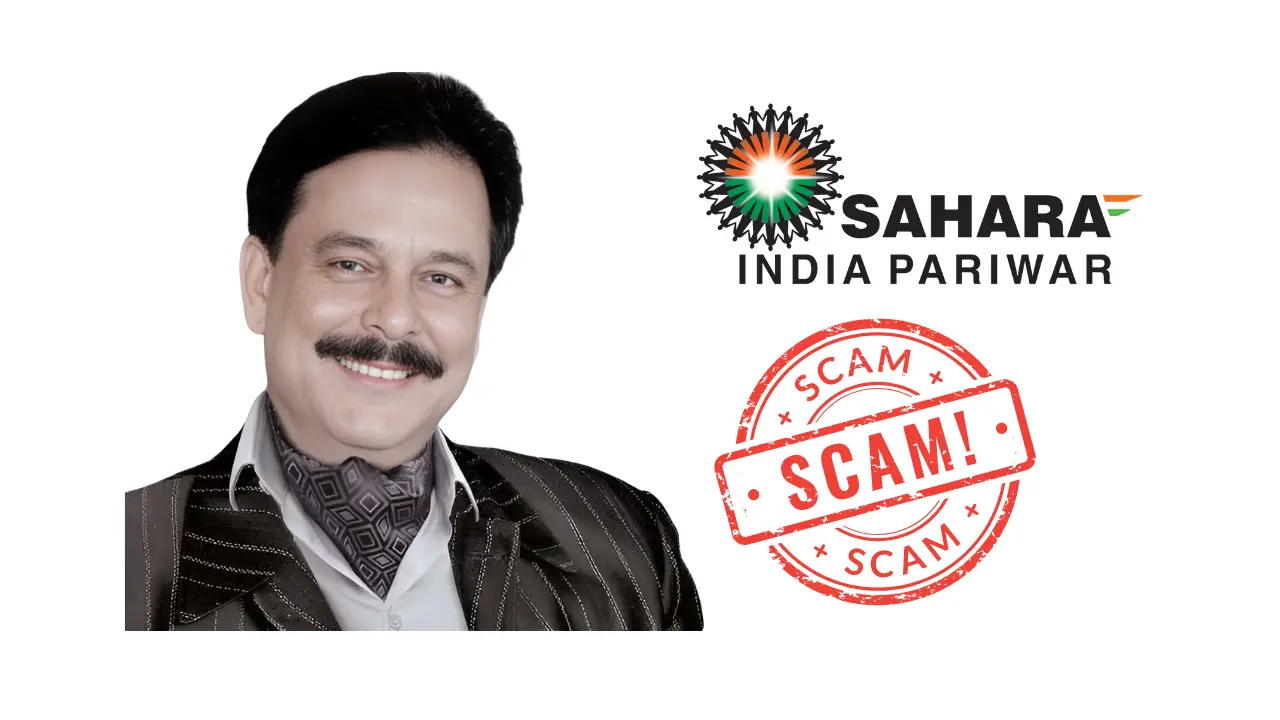

The Sahara Scam shocked India’s financial world. Sahara Group argued that its OFCDs fell under the ROC’s jurisdiction, clashing with SEBI and igniting a major conflict.

The financial tsunami originating from the Sahara fraud

Although SEBI disagreed with Sahara’s claims, it claimed to have followed ROC guidelines. Their advice to Sahara to stop issuing bonds and return money to customers worsened matters and resulted in a dispute all the way to the Supreme Court.

The Refund Fiasco

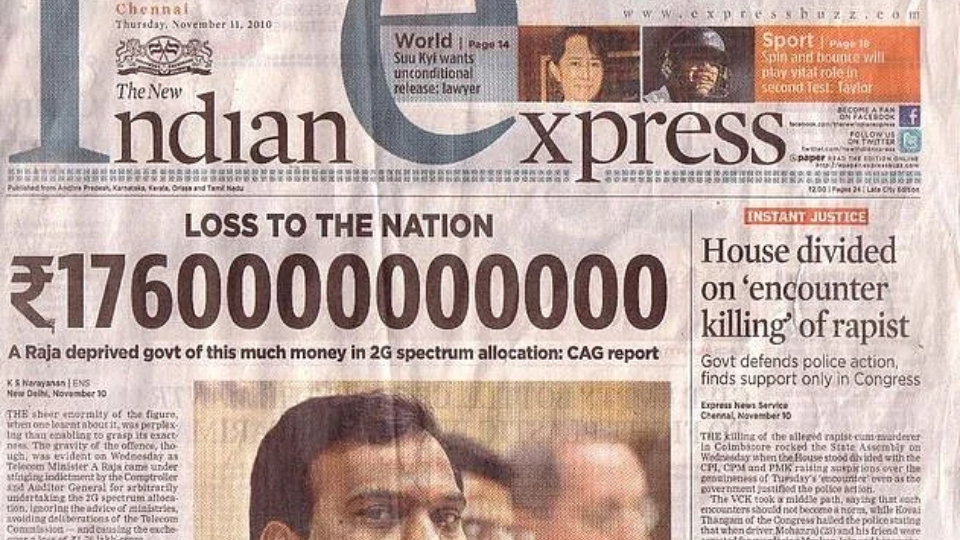

Sahara said it had paid back 93% of its investors and placed over Rs. 16,000 crore into a special account—a lot more than what it owed—while the Supreme Court considered the matter. However, SEBI’s vigorous search for investors revealed a startling truth: just roughly 4,600 individuals came forward to demand refunds. Sahara said that the difference was due to SEBI’s poor handling of affairs; it had already paid back the majority of the investors directly.

The Legal Circus

Strange events began when Sahara arrived at SEBI’s headquarters in 2013 with 127 vehicles loaded with investor documentation. This created a traffic congestion around Mumbai’s periphery. SEBI had to reject a lot of the papers given the tight deadline and high volume. Not that things stopped there. Sahara’s documentation crisis revealed the scope of the issue, with almost Rs. 24,000 crore acquired from three crore people.

Subrata Roy’s legal drama

The face of the crisis turned out to be Sahara Chairman Subrata Roy. Roy missed court before the Supreme Court, hence he was arrested in 2014. He engaged in numerous court battles; he was imprisoned then paroled in 2016. Roy and Sahara claimed during the entire process that the charges were paid for political purposes, therefore linking their issues to a more general political agenda.

Aid, opposition, and the road forward—the continuous struggle

Though a lot of money has been paid and court battles are still under progress, the Sahara Scam is still not resolved as of early 2021. Though there are still differences, the Delhi High Court enabled Sahara enterprises to continue operating. Although Sahara claims to have paid back a significant portion of the loan, the matter is still highly complex, so the controversy is still much discussed in Indian legal and financial spheres.